It’s really hard to have a conversation with or about SAP without hearing something about RISE with SAP. Its dominant position in the marketing and sales efforts of the company has made it inescapable, whether you’re a customer listening to yet another keynote presentation or sales exec’s pitch, or you’re a partner trying to understand where you fit into this all-encompassing and, frankly, somewhat confusing initiative.

What’s clear is that RISE can be distilled down to these three goals: get more SAP customers to move more workloads to S/4HANA and the cloud by trying to simplify contracting and cloud adoption; promote the use of SAP’s Business Technology Platform and put a dent in hyperscalers’ ability to compete with SAP in the all-important arena of tech-stack adoption; and give SAP an opportunity to tell Wall Street every quarter how successful its cloud sales efforts are.

RISE is clearly a winner on all three fronts. S/4HANA is moving forward steadily, both within the installed base and among net new customers, with a little under 50% of all S/4HANA deals falling under a RISE contract. I’m guessing SAP should hit 15,000 live instances this quarter, if it hasn’t already. Importantly, the customers I’ve spoken to that are running S/4HANA are using it to drive real innovation, along with rationalizing their portfolios on the cloud.

BTP is also doing well, with over 12,000 customers, according to SAP, also in part because of the draft created by RISE, even if a significant number are using BTP by default and not necessarily as a strategic asset, at least not initially. I’d still chalk that up as a success: if BTP is able to do what SAP says it can do, its usage among these existing customers should go up steadily as customers familiarize themselves with its broad set of capabilities.

Re Wall Street: The numbers SAP reports for each earnings call should be impressing Wall Street, but whether RISE is impressing Wall Street enough is unclear. Judging by SAP’s stock price relative to some competitors, Wall Street is still guilty of conflating the enterprise software tech market with consumer tech; and hybrid enterprise software tech with pure-cloud tech. Unfortunately it’s all tech to a myopic market than can’t see further than 90 days out, a problem that SAP has had to deal with forever. So there’s probably no pleasing Wall Street when it comes to a company like SAP that is competing in the cloud with pure cloud companies like Salesforce.com and Workday while simultaneously competing with companies like Oracle, Infor and others that have a significant legacy customer base as well. And no pleasing a popular business press that all too often compares SAP to Netflix, Uber, Coinbase, and others. Sigh.

Regardless, what’s unfortunately all too clear is that RISE does not explicitly exist to make customers more successful in their project execution, save them real time and money, or achieve greater productivity for their users or customers. And, if you’re preferred partner is not among the anointed few in the RISE partner program, it’s unfortunately very unclear what your partner’s role in the SAP ecosystem and their existing customer relationships are supposed to look like under RISE. As these partner customers are also SAP customers, that uncertainty isn’t healthy for anyone, including SAP.

Conversely, despite the sense among some SAPpers that this is a problem, what is clear is that RISE isn’t making much of dent in helping customers with complex ECC landscapes, extensive customizations, complicated service and maintenance requirements, or the deployment of industry-specific use cases. Which is actually a positive, a point I’ll get to in a moment.

It’s not that RISE couldn’t theoretically help with customer success, project execution, and productivity gains, it’s just that these aren’t areas that RISE by itself can influence. There is nothing explicit about RISE that makes SAP’s track record in implementation success better or improves customers’ TCO. Sure, plenty of customers utilizing RISE contracts have successful implementations – as in they are done largely on time and on budget, while meeting pre-defined expectations of success. It’s just that that success is more correctly attributable to impact of business process standardization in the cloud. Moving from a tangled mess of customized on-prem processes to a sleek cloud instance running a majority of standardized processes is going to have a huge impact, regardless of whether it’s taking place under the auspices or RISE or not.

RISE or no RISE, SAP, like the entire enterprise software industry, still struggles with delivering successful projects. It’s clear that the process standardization and simplification implicit in the move to SaaS also help guarantee a higher degree of success than is possible in the old on-prem model. But the problems with delivering successful implementation projects have not been alleviated by RISE. Indeed, the fact that the all-important services contract for dealing with the non-cookie cutter complexities of an implementation are still contracted separately with a third-party partner means that SAP has punted on the opportunity to use RISE to systematically ride herd over partner success.

This is just sad, as RISE unfortunately tilts too far in favoring the very GSIs who consistently screw up large projects for SAP and the rest of the enterprise software industry. Real customer success can’t be achieved until SAP enforces partner compliance among its GSI partners – and the rest of the partners, for that matter – with minimum standards and milestones for genuine implementation management, something SAP only claims to be doing using internal measures that hide the truth behind its cloud implementation success rates. Which as far as I can tell aren’t dramatically different than they were before RISE.

Nonetheless, kudos to RISE for selling a lot of S/4HANA and cloud to smaller existing customers and net-new logos, a clear sign of success for a customer segment that can really benefit from the simplification implicit in RISE. But large enterprises with extensive legacy SAP landscapes and companies of all sizes with extensive customizations or deep industry-specific requirements are not solving these types of challenges under the RISE rubric in similar numbers.

That’s why some two-thirds of existing ECC customers haven’t made a move to RISE yet, and more than half of S/4HANA implementations are not being handled under a RISE contract. Service and support for the standardized landscapes and business processes that RISE focuses on works well, but the real world needs of many SAP customers requires more in the implementation, support, and maintenance domain than what out-of-the-box RISE can offer. And customizations continue to be the gift that keeps on taking: ECC customers have hundreds, if not thousands, of customizations that have to be managed as part of an upgrade or migration process. Dealing with the complexities of many SAP customers’ customization questions isn’t something that RISE concerns itself with.

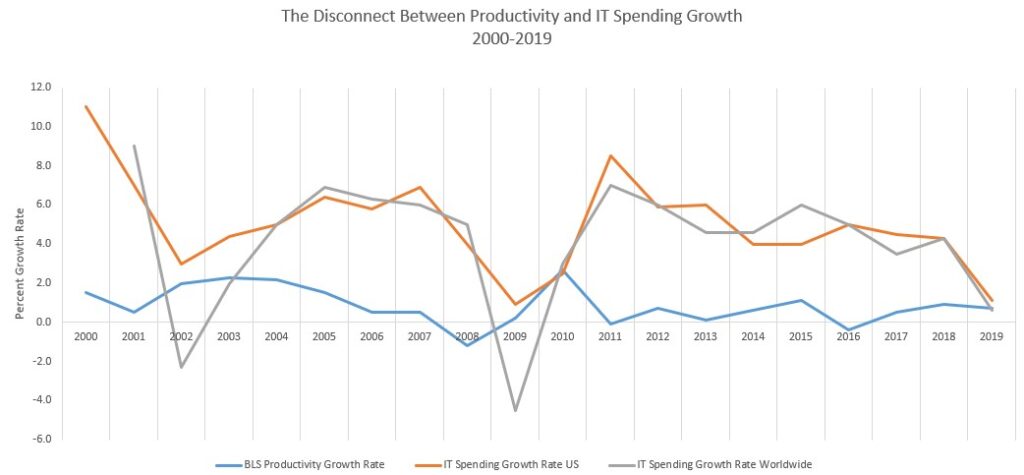

What about improved productivity with RISE? It’s frankly too early to look at RISE as a guarantor of better productivity – contract simplification theoretically improves the productivity of the procurement process, and process standardization and the move to the cloud can also improve overall productivity. But only theoretically: over two decades of a steady migration of business processes to the cloud across the global economy have yet to yield measurable gains in productivity at the macro-economic level. Despite significant annual growth in IT spending this century, growth in productivity has remained stagnant.

Copyright EAC 2022

There have been significant productivity gains from cloud migration at the individual company and business sector level, but there is no universal effect that could allow SAP or any other company to claim that a program like RISE can guarantee improved overall capital and employee productivity. Lowering initial capex spend and subscription pricing models don’t always compensate for the cost of migration, re-implementation, integration, process change, and the rest of what happens when companies transform in the cloud. Looking for real productivity gains in the initial years after a cloud migration and ERP upgrade project will usually yield disappointing results.

Meanwhile, for partners, particularly boutique partners, RISE has become yet another roadblock in a sales cycle that seems to have only gotten longer and more complex, despite SAP’s promises of simplification and an improved partner ecosystem. SAP’s ambiguous and confusing stances on the role of non-GSI partners in RISE has made these companies’ lives – and, even more importantly, the lives of their mutual SAP customers – more complex and confusing. It’s unfortunately another example of the SAP partner program making things harder for customers by making things harder for partners, under the guise of making things easier for SAP.

What’s clear is that RISE is working in terms of moving SAP customers to the cloud and S/4HANA, and the many RISE success stories SAP is publishing, and the sales success SAP is touting to Wall Street for both S/4HANA and RISE, are testimony to the fact that customers are voting for RISE with their wallets. By those metrics RISE is a success. And S/4HANA adoption is moving along steadily independent of RISE among existing clients at a pace that makes sense, especially for installed base customers that can’t necessarily make use of RISE due to the complexity of their existing SAP landscapes.

So, let’s be very clear: RISE isn’t for everyone – or even the majority of customers, at least not yet. Which is why the fact that two-thirds of ECC customers haven’t jumped on S/4HANA or RISE, or that a recent survey from DSAG, the German SAP User Group, stating that a majority of DSAG customers are not considering RISE, should be seen as the result of either a pragmatic and informed opinion on the part of customers or good old installed-base caution, not a failure of RISE itself.

That’s an important distinction: despite the impression from SAP marketing that RISE is the only road to success with SAP, there are still a majority of companies that, since RISE’s inception, have chosen not to contract with SAP under the RISE umbrella. For lots of good reasons, most of which have to do with the complexity of their migration, implementation, or services needs. Not coincidentally, a majority of SAP customers still haven’t committed to moving to S/4HANA either. I’m pretty confident those two numbers will eventually shift towards the twin goals of RISE’s dominance in the sales cycle and S/4HANA’s hegemony in the customers’ technology stack, but crossing the RISE/S4 rubicon will take more time than SAP would probably like. Hopefully Wall Street will show some rare forebearance in this regard.

In the spirit of helping customers navigate the possibilities of RISE, here are ten questions customers should be asking themselves, and their sales reps, about whether to RISE or not to RISE.

- Do we have to use RISE, or is there some better way to move to S/4HANA and the cloud? Unless you’re talking about a pure greenfield, net-new implementation, make sure there’s a non-RISE option on the table from the start. Especially if you may need more than the standard implementation, development, or management services that come with RISE.

- What will happen to my specific requirements for my industry and my competitive profile under a RISE contract? This question is super important when it comes to industry-specific processes: the ones you need may not yet be in the GA version SAP is selling this quarter. SAP’s Industry Clouds are progressing well in covering the broad spectrum of processes that ECC covers, but they are far from complete. So if industry processes are key to your ultimate success, you need to insist on a detailed and believable roadmap for when those features will be available before you commit to RISE-based standardization. If they’re not available, you may need to make your move outside of RISE.

- Who will build and maintain the customizations and industry specific functions we need per #2 above? If there’s any question about the availability of a specific standardized process that can replace your custom process in a timely fashion, you’ll need a partner that can migrate and/or restage the ones you need as extensions on BTP or a hyperscaler platform. That kind of project isn’t covered in a standard RISE contract.

- What does RISE mean for my existing hyperscaler contracts? Many companies are already doing business with a hyperscaler and it may be advantageous to incorporate the new workloads that might have come under a RISE contract into an existing contract independent of SAP and RISE. Don’t take “don’t worry” for an answer from SAP: get a contracting expert to help make sure you’re not saving money on RISE only to miss a chance to save elsewhere.

- What does RISE mean for my existing boutique partner relationship? The partner ecosystem is full of excellent companies that are successful precisely because that can provide services and service level agreements that GSIs can’t or won’t match. Many SAP customers prefer to do business with smaller firms, and RISE should do a much better job encouraging these relationships and stop being a barrier to them and their sales cycles. Sticking with a preferred partner with a proven track record at your company is worth more in my opinion than some minor licensing discount, so if that means foregoing RISE, go for it.

- How will RISE support my company’s needs for hybrid landscapes? By hybrid I mean both mixed on-prem/cloud systems as well as multi-cloud systems. Be sure you’d not walking into even greater complexity on the way to trying to simplify things. Again, your existing hyperscaler contracts might be leveraged in this regard to your advantage.

- How will RISE support my needs to incrementally adopt S/4HANA? Don’t be lured into the false comfort of contract simplification at the expense of keeping an eye on the real prize: continuous transformation. Many companies, particularly in the installed base, will need multiple projects in order to fully transform their businesses in the cloud on S/4HANA. Make sure you have your own roadmap for moving to the cloud first, and then see if RISE fits it or not.

- How will RISE support my use of non-SAP software and technology? RISE doesn’t do enough to acknowledge the heterogeneity in the existing or prospective customer base, and a standard RISE contract may not be enough to transform your complex, heterogeneous, end-to-end processes if some major competitor’s product is in the mix. Make sure those needs are well understood before you sit down to talk about RISE.

- How will RISE support my company’s innovation needs? Often the job of transformative innovation is lost in the usual talking points about RISE’s contract simplification. There’s a lot about RISE that’s more than just moving to the cloud and innovating the contracting of SAP software, so don’t lose sight of this key requirement. RISE has a ton of serious innovation built into its offerings, such as the Business Network, that are worth a look.

- What guarantees can SAP provide in terms of implementation success under RISE? Asked and answered, as they say in courtroom dramas: the answer is no, but that shouldn’t stop anyone from asking. SAP and the rest of the industry have monkeyed around with the concept of implementation success for way too long, and have successfully punted on some really easy and customer-friendly ways of doing a better job in this most basic requirement. Only customers can force SAP and its competitors (and SI partners) to put real teeth into its implementation process.

It’s important that the fact the RISE doesn’t have to be for everyone will hopefully be seen as a positive, just like SAP’s support for a mix of public and private clouds and hybrid cloud/on-premise landscapes is a positive (despite all the yammering about SAP’s violating “cloud orthodoxy” in offering so broad a set of choices.) Customer choice is the ultimate starting point for customer success, and the RISE/not RISE option should be embraced as good for SAP’s customers, and partners, as well as SAP.

Leave a Reply